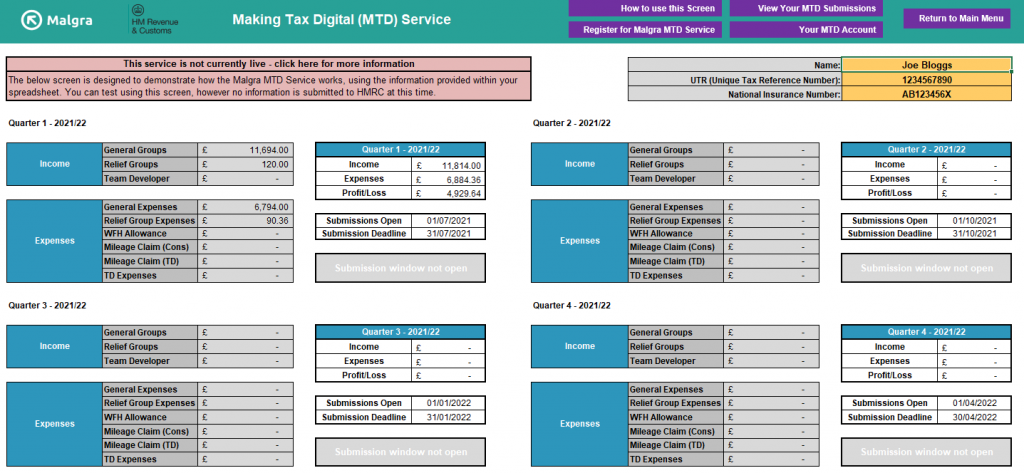

This is a demo feature: MTD does not yet come into affect, and therefore these screens and functions are in ‘demo’ mode. You can view information and click links – but no information will be submitted to HMRC at this time

Making Tax Digital is HMRC’s next major change to self employment which will require quarterly reporting on your business in respect of income, expenses and profit.

The 21/22 Spreadsheet provides an overview at how this new service will work with a new MTD Service dashboard. You can access this through the main dashboard by clicking the MTD button.

At the top in orange, the system allows you to confirm your HMRC details – your UTR and National Insurance Number. These are currently showing demo numbers, and therefore can be ignored.

Navigation

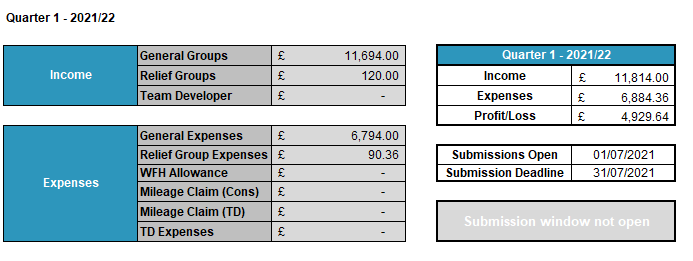

The screen is split into 4 different quarters as required for reporting through the MTD system. The top left covers Quarter 1 for 21/22 as an example.

The tables calculate the relevant information for your MTD return from the information contained within the spreadsheet. In the example above, the income from running groups and relief groups are listed, along with expenses for the period for general group running and also from the relief.

The total for the period of income is £11,814 and expenses £6,884.36 – leaving a profit of £4,929.64.

The dates cover the indicative periods of when the return can be submitted to HMRC. In this example for Quarter 1 (April – June), the window to submit opens on 1 July and runs until the end of the month (31 July).

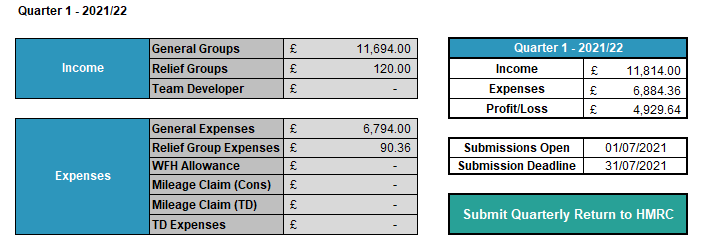

This screenshot was taken on 2 March 2021, therefore the window is closed – the button clearly explains that the window for submission is not yet open. However, if you were to view this screen within the period, the button becomes active.

On clicking the button, the system takes you to the Malgra MTD Website to complete your submission as required under the MTD Service.

Note: If you click the button, the system will currently take you to a demo version of the online MTD Service. We’ve provided this as an example to you of how the service is expected the work to prepare you for the changes – however there is currently no requirement to take part in MTD and the system will not submit any information to HMRC.